Feb. 21, 2023

Survey reveals key WOZ figures by municipality

Weert, Feb. 21, 2023 ... Millions of Dutch people may be paying too much WOZ tax, according to a report of WOZwet.nl. The agency, which assists citizens who want to reduce their WOZ value, combined data from various government sources and its own data for the study. 'It is unacceptable that so many households are wrongfully paying too much WOZ taxes.'

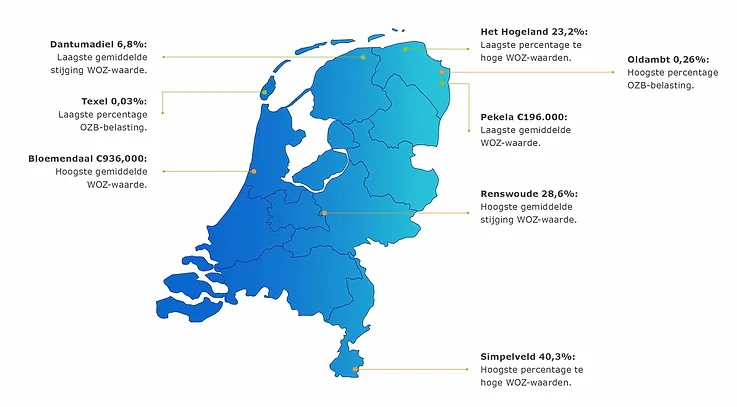

Photo: In the report, WOZwet.nl specialists not only address the national state of the WOZ sector, they also provide insight into the most important WOZ figures for each municipality.

Municipalities are responsible for determining the WOZ value. They do this by appraising a property. This is often not done by an appraiser, but by a computer system. And that is where things regularly go wrong. In almost 40 percent of the cases the WOZ-value is lowered after an objection; often this is because computers misjudge the quality, luxury or maintenance of the house, according to the research of WOZwet.nl. In total, one in three Dutch people may be paying too much WOZ tax.

WOZwet.nl analyzed its own figures, data from CBS, the University of Groningen, the Scientific Research and Documentation Center and three reports from the Valuation Chamber at the municipal level.

Figures per municipality; from 'Aa and Hunze' to 'Zwolle'

In the report the specialists of WOZwet.nl not only discuss the national state of the WOZ sector, they also provide insight into the most important WOZ figures per municipality, from A to Z or from AA and Hunze to Zwolle. Think of the average WOZ value and increase, tax rates, the number of WOZ objections of last year and the percentage WOZ values that may be too high. For example, the average WOZ value increased the most in Renswoude (Utrecht) with 28.6% and the least in Dantumadiel (Friesland) with 6.8%. The average WOZ value turned out to be highest this year in Bloemendaal (North Holland) with

€ 936,000 and lowest in Pekela (Groningen) at € 196,000.

No freeloaders

Every year, 11 billion euros flow into government coffers (municipalities as well as the national government) through the various WOZ taxes. On average, this amounts to 1,358 euros per household. When an agency proves that the WOZ value is too high, the municipality pays the fee to the agency. In this way, the citizen does not pay those costs and the threshold for taking on his own municipality is lower. Meanwhile, municipalities are increasingly critical of the WOZ agencies and discourage their citizens from using this form of legal aid. 'As far as we are concerned, municipalities can better spend budget and energy on preventing problems in advance, by calculating the WOZ value more accurately,' says Joas Hollander. He works as a lawyer for WOZwet.nl, which will lower WOZ values for citizens for more than 40 million euros in 2022.

Former Minister of Legal Protection Sander Dekker came out with an investigation into WOZ agencies in 2021. This showed that there was no "taking advantage" by the majority of agencies. The overall impression of these firms was positive. Moreover, the fee the industry receives from municipalities (€18 million) is only 0.16 percent of the total taxes the government collects through the WOZ.

About WOZwet.nl

The goal of WOZwet.nl is that everyone in the Netherlands is assigned a fair WOZ value. WOZwet.nl finds it unacceptable that this is not yet happening and that, as a result, millions of Dutch people are paying unjustly too much tax. The company specializes in lowering WOZ values of private homes for sale. The company is growing rapidly: WOZwet.nl is the third largest WOZ agency in the Netherlands and in 2022 handled as many as 1 in 14 professional WOZ objections. To determine whether a home's WOZ value is too high, WOZwet.nl checks for 120 WOZ lowering factors and compares the WOZ value with 30 recently sold homes.